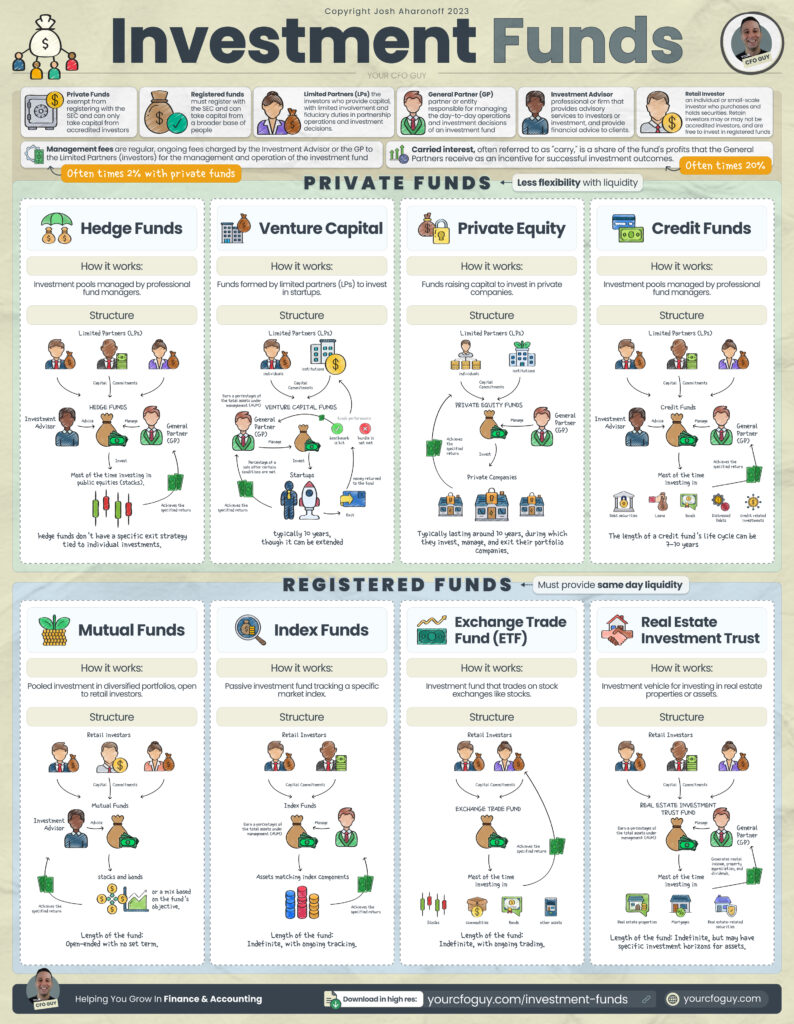

In the world of finance, diversification and risk management are cornerstones for investors. Mutual funds offer an avenue to achieve these goals, allowing individuals to pool their money into a professionally managed pool of investments. But how do these funds differ and what is the structure behind each? A recent educational diagram by Josh Aharonoff from 2023 provides a clear and concise overview of the different types of mutual funds and how they work.

Private Funds: Flexibility vs. Liquidity

Private funds, which include hedge funds, venture capital, private equity and credit funds, are notable for their lighter regulation compared to registered funds. These funds are typically available only to accredited investors and offer a broader range of investment strategies. However, they often have higher investment requirements and offer less liquidity, which means that investors cannot withdraw their money at any time.

Registered Funds: Access and Liquidity for the Average Investor

On the other hand, registered funds, such as mutual funds, index funds, ETFs and REITs, must provide same-day liquidity, making them more accessible to the average investor. These funds follow strict regulations and are designed to track market indexes or invest in a variety of assets, allowing investors to diversify their portfolios with ease.

The diagram provided by Aharonoff highlights the importance of understanding the structure and characteristics of each fund before investing. With intuitive illustrations and brief explanations, this educational resource is a valuable tool for anyone looking to navigate the vast sea of investment options.